Employee Retention Credit (ERC) up to $33,000 per EE

Employee Retention Credit (ERC) up to $33,000 per EE

The CARES Act Employee Retention Credit (ERC) gives up to $33,000 per employee to eligible employers.

Examples:

- 60-employee Hotel Group – $1.5 Million

- 75-employee Nursing Home – $1.75 Million

- 7-employee Not for Profit – $200,000

- 33-employee Appliance Distributor – $745,000

The Employee Retention Credit (ERC) experts at DCI Solutions help you

- Establish your ERC claim. Every DCI client sees tax savings using DCI’s expertise, including those who thought they weren’t eligible for ERC.

- Maximize your ERC claim. Your success requires we maximize the money you are eligible for and leave nothing on the table.

- Document your ERC claim. It’s not enough to qualify you must have your ERC claim documented thoroughly in the event of an audit

DCI can add additional tax incentives and grants to make your financial gain even larger.

Call for a FREE consultation today!

(888) 395-0809 or info@dcisolutions.net

We’ll explain everything simply and give you a forecast so you know what to expect.

Q: What is the Employee Retention Credit (ERC)?

The Employee Retention Credit (ERC) is a CARES ACT incentive that gives special funds to eligible businesses who keep some or most of their employees on payroll.

Q: How much money can I get back from the Employee Retention Credit (ERC)?

The Employee Retention Credit (ERC) provides business owners up to

- $5,000 per full-time employee retained between Oct 1, 2020 and De 31, 2020.

- $28,000 per full-time employee retained between Jan 1, 2021 and Dec 31, 2021.

- $33,000 Maximum Credit per Employee

Example: Employer with 31 employees could get over $1 Million! (31 EE X $33,000 per EE = $1,023,000)

Q: How do I qualify for the Employee Retention Credit (ERC)?

There are many ways to qualify and many companies that could qualify unknowingly fail to pursue or maximize the ERC money owed to them. Two of the many ways to qualify are:

- Have a significant disruption in supply chain.

- Have a 20% reduction in gross receipts in 2021 compared to 2019.

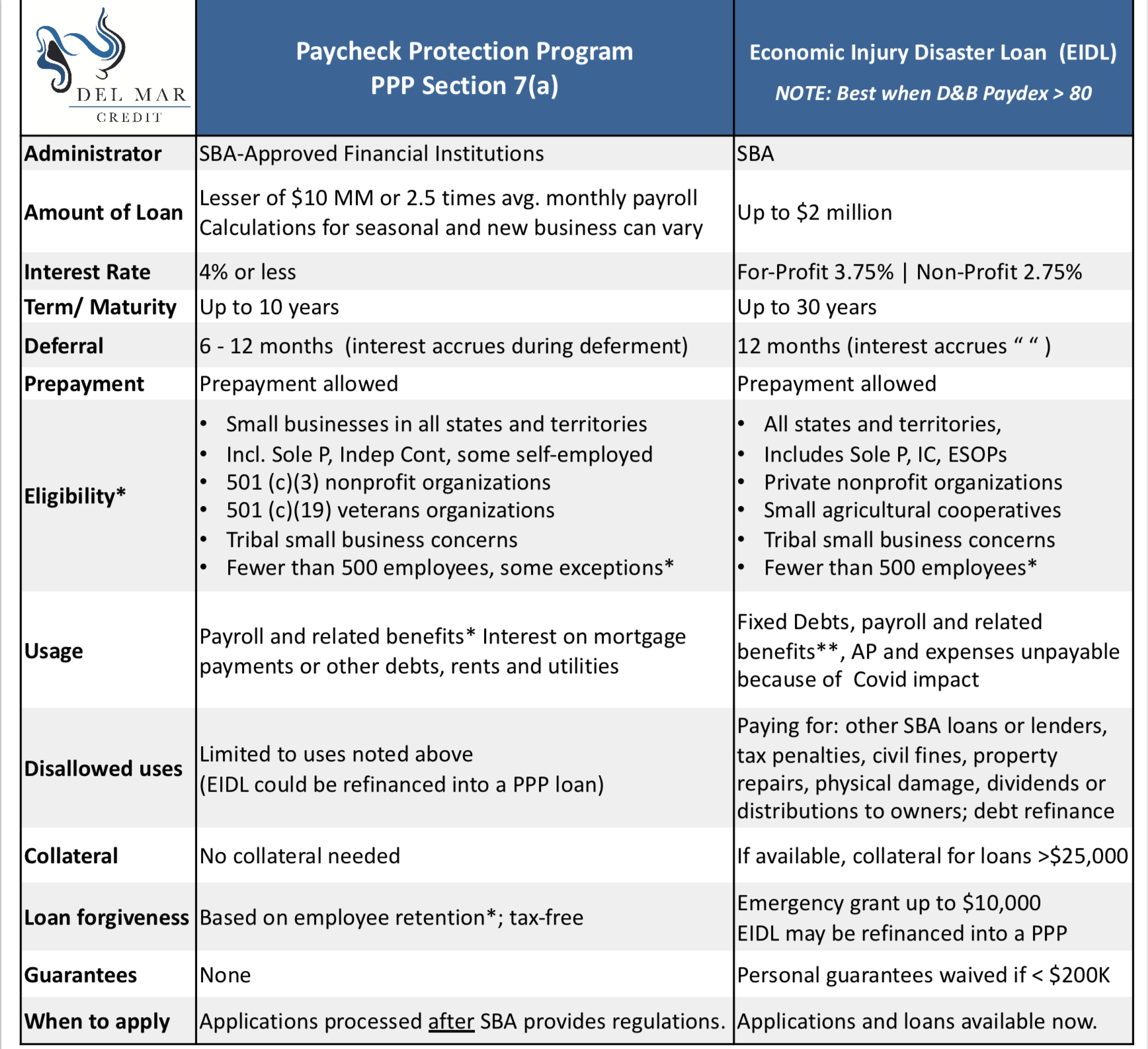

Q: Can I become eligible if I got a PPP loan?

Companies which received PPP loans can also be eligible for ERC $. The amount of your PPP loan will be deducted from the amount of your ERC funds if you are eligible.

Q: Do Not-for-profits qualify?

YES.

Q: Will the IRS audit my taxes if I get money with the Employee Retention Credit?

Probably. The IRS may audit every business who files for the Employee Retention Credit (ERC). It is critical you use the expertise of specialists who are familiar with the process to ensure your audit file is bullet-proof. You want to maximize your funds in the smartest, most prudent way.

Q: Where can I file the forms for the Employee Retention Credit (ERC)?

DCI Solutions will make all the necessary filings as part of our service offering to help you maximize the money you get from the Employee Retention Credit (ERC).

Book a free consultation today!

(888) 395-0809 or info@dcisolutions.net

to see if your business qualifies and how much the IRS owes you.

Avoid three big mistakes business owners make with ERC money:

- “I’m not eligible because ________.” (I got a PPP, I laid off people, revenue didn’t drop. etc.)

- “My CPA does that for me.” (CPAs and bookkeepers refer ERC to tax credit specialty firms like DCI. It is not recommended to use bookkeeper or accountant for these credits as they do not have the expertise to correctly maximize your funds or to protect you in the event of an audit.)

- “Maybe I’ll figure it out myself.” (With all your free time?! You’re running a company!)

Check the IRS Regulations

https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act

DCI has generated millions in ERC claims for our clients. Many are businesses with fewer than 20 employees.

Our Streamlined Process

- Contact DCI Solutions for a FREE consultation.

- Send a completed questionnaire, payroll data, and 941 returns.

- DCI reviews with you your credit calculations and 941-X amended payroll returns.

- Receive payment from the Treasury Department in 3-5 months.

Disclaimer: This information should not be construed as legal, accounting or tax advice or opinion and may not be applicable to the reader’s specific circumstances, and may require consideration of non-tax and other tax factors. The reader should contact DCI Solutions for a consultation in all cases. DCI Solutions is not obligated to post any changes in tax laws or other factors that could affect the information already posted.