Healthcare Savings

Elite CHROs/CFOs aren’t fooled by Rx rebates

Compare This Blue Cross Gold Plan To Yours

Reducing Health Insurance Expenses

DCI produces sustainable reductions of 30% or more in healthcare costs for companies that don’t want to depend exclusively on commissioned brokers for cost savings strategies.

Myths & Facts

MYTH: If there were a better plan for us, my broker would have told me.

FACT: Brokers might not tell you about solutions that offer no commission.

MYTH: Busy CEOs tend not to care deeply about healthcare details.

FACT: CEOs will focus on a 15% to 30% reduction in the cost of healthcare once the analysis is on their desk.

MYTH: We should trust our broker and look for savings elsewhere.

FACT: Brokers and salespeople rarely understand the detailed construction (and pricing) that goes into reducing the cost of care below $10,000 per employee per year and fewer still are able to create quality coverage for under $5,000 per employee per year.

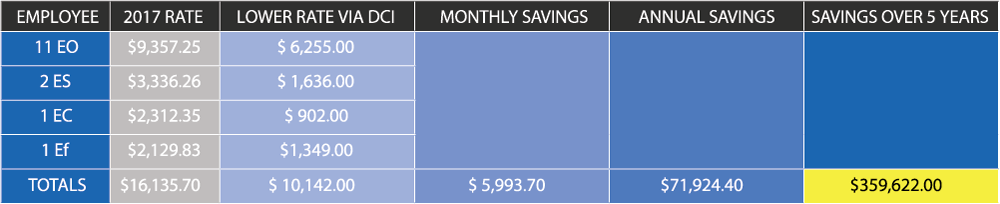

TYPICAL DCI SAVINGS FORECAST:

SAME DOCTORS, SAME SILVER PPO BENEFITS, 37% SAVINGS

7 WAYS TO CUT HEALTHCARE COSTS

1.

TRUSTS AND VEBAS

are only accessible to certain brokers and help compa- nies under 200 ee replicate current benefits at a 20% to 40% lower cost.

2.

FULLY SUBSIDIZED WELLNESS PLANS

reduce claims 20% long term at no cost to the employer.

3.

TECHNOLOGY THAT AUTOMATES BENEFITS

suits a workforce that books their vacations via smart phone, eliminating the need for your HR department to play “travel agent.”

4.

LEVEL FUNDING

(hybrid or partially self-insured) reduces carrier profit margins and risk charges. It also eliminates the 3% insurance state tax.

5.

REFERENCE-BASED PRICING

sets pre-negotiated pricing in certain networks that accept 140% to 200% of Medicare payments in exchange for timely payment and eliminates dependence on PPO “discounts.”

6.

CONSUMER DIRECTED-HEALTH PLANS

give employees financial incentives to make decisions that drive down employer costs. Examples include free telemedicine, free gener- ic drugs, and subsidies to employees who join their spouses’ plans.

7.

HEALTHCARE COST AUDITS

give the CEO an accurate benchmark analysis of commissions, costs, and “double dips” in medical and drug plans without alerting the carrier, TPA, broker, or PBM.