2nd of 20 Best Practices to Improve Cash Flow and Productivity with NO LAYOFFS and NO SACRIFICE

2nd of 20 Best Practices to Improve Cash Flow and Productivity with NO LAYOFFS and NO SACRIFICE

Optimize productivity and cash position and cash flow:

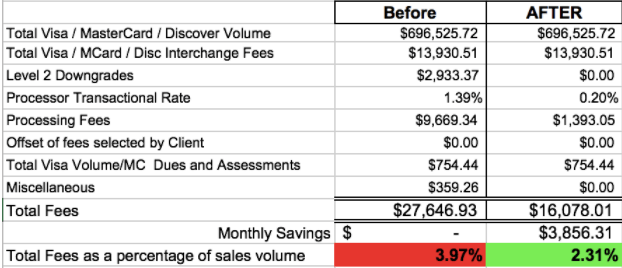

When your business takes payment by credit card, the transaction fees that you pay might be as high as 4%.

This means if your company has $10MM in card transactions, you pay $200,000-$400,000 in fees unless you offset those fees (which you can do all the way to zero in some cases).

If your company takes payment by credit card from other companies, the interchange rate for B2B transactions automatically jumps even higher (an extra 1% sometimes) if you do not enter the additional data mandated by the card brands.

That increase means if you have $10 MM in B2B card transactions, you could be paying up to $450,000 in total fees.

Working remotely, you can get a lot of that money back. Sometimes all of it.

Step 1 – You eliminate that B2B interchange penalty if you manually populate all the requested fields or, better yet, just authorize the integration of an automated workaround.

Step 2 – You begin reducing your fees by sending a letter like the one below, including an independent analysis (see example below) and, if you like, a competing proposal.

Dear Bank/Card Processor,

We are evaluating our costs, including our costs for card processing as you can see in the attached fee analysis.

We also have received this proposal you see attached for month-to-month service with competitive terms and no exit penalties.

Could you please respond with a competitive bid and send it to me at your soonest? Our company would like to activate these savings quickly.

Thank you

We offer advisors a true win-win solution that really moves the needle for their clients and we build great relationships with any trusted advisor who would like to bring this kind of added value to their client base. To learn more, contact DCI at info@dcisolutions.net or (888) 395-0809