INCREASE CASH FLOW

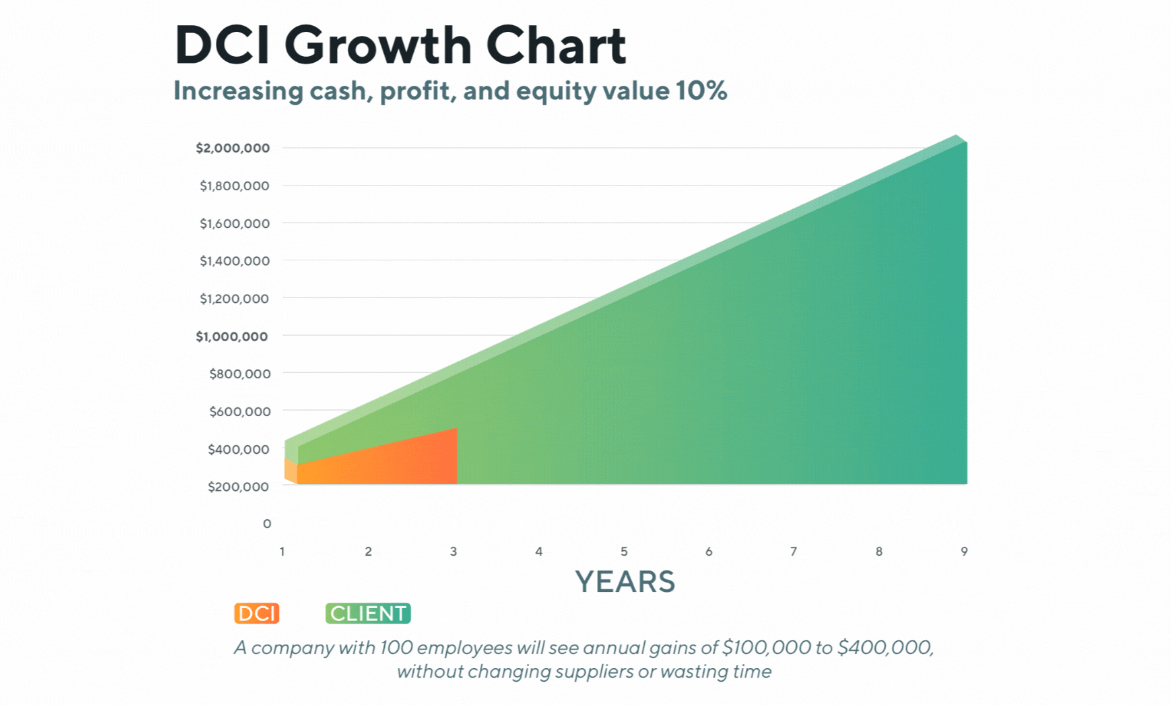

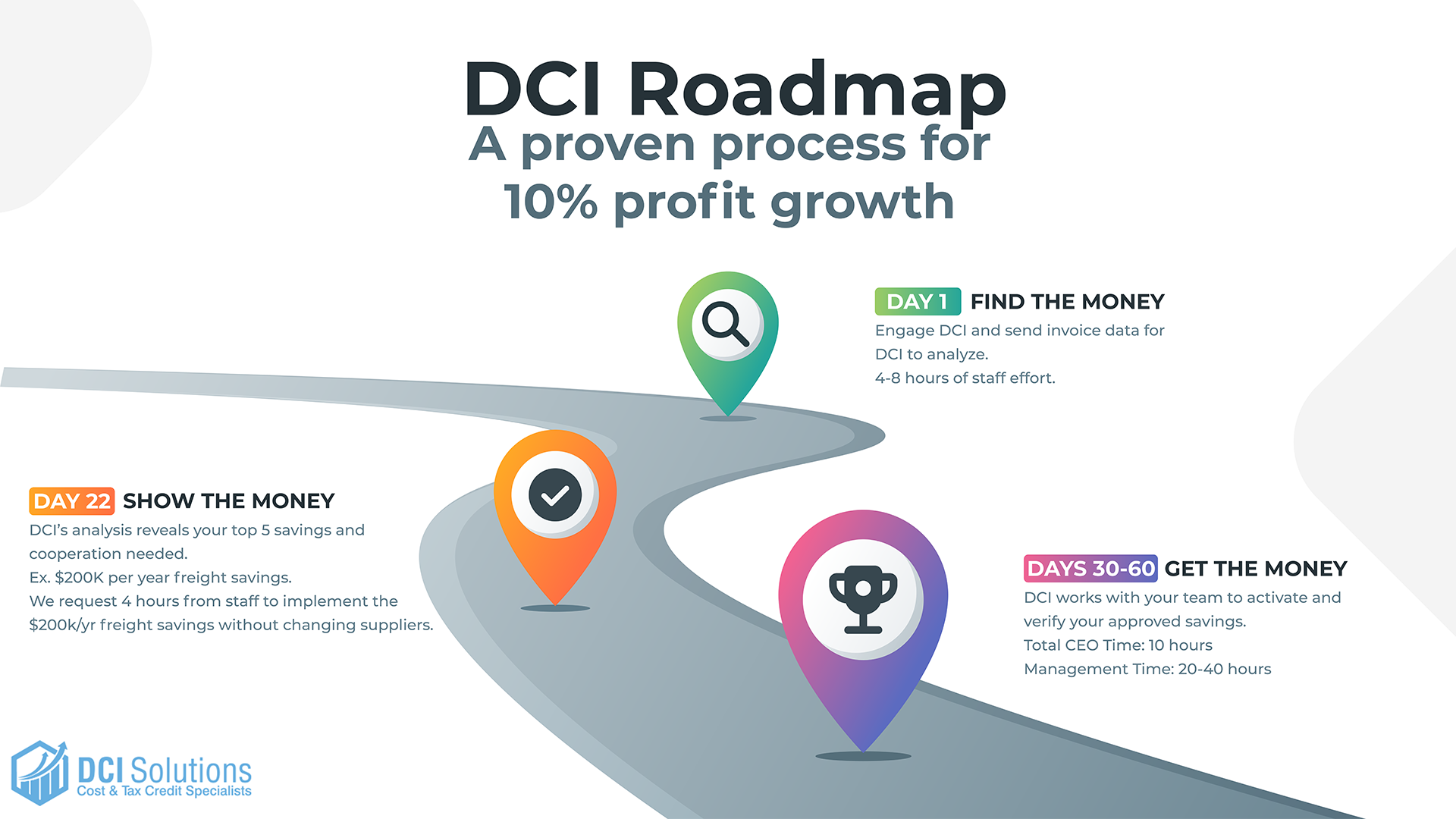

The company worth $50 million on Monday could be worth $55 million on Friday

Companies of any size realize average gains of $1k - $4k per full time employee without changing suppliers or wasting time.

¿Tienes alguna duda? ¡Estamos aquí para ayudarte!

$1000

MINIMUM SAVINGS PER EMPLOYEE PER YEAR

10%

UP TO 10% INCREASE TO ANNUAL BOTTOM LINE PROFITS

1

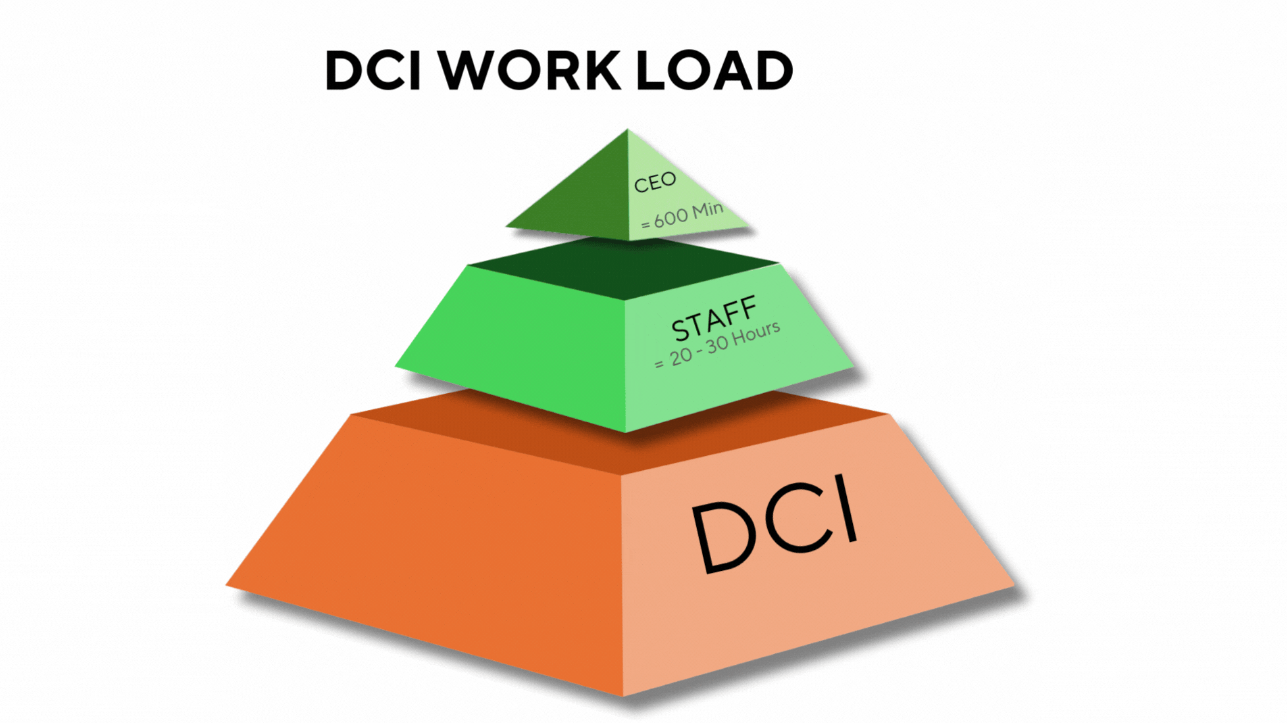

TOTAL DAYS OF EXECUTIVE TIME (8-1O HOURS)

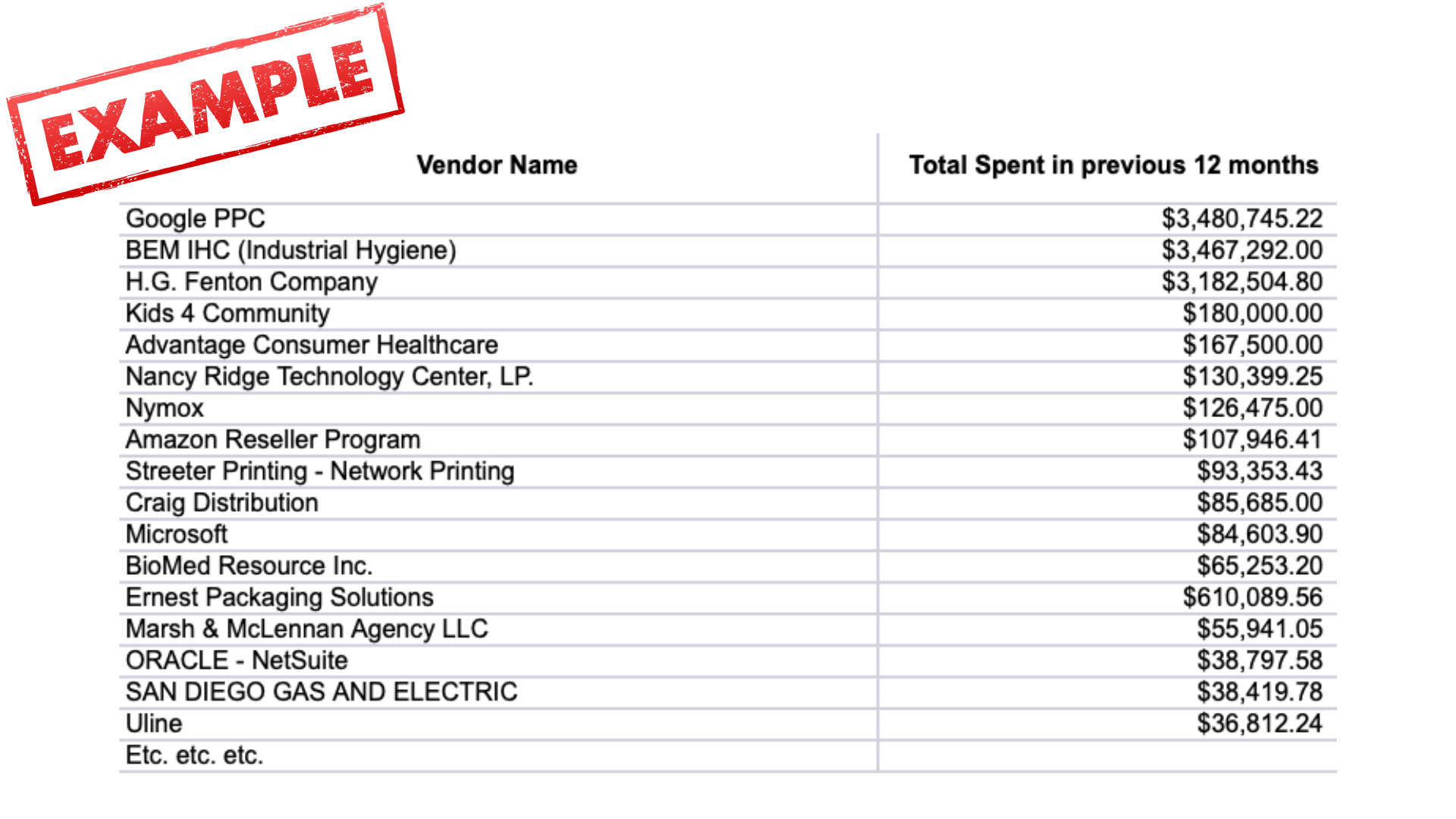

Cost Efficiency Dashboard

-

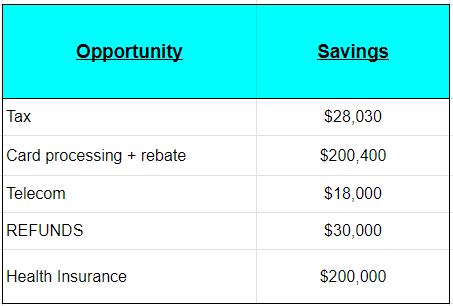

Tax Credits

-

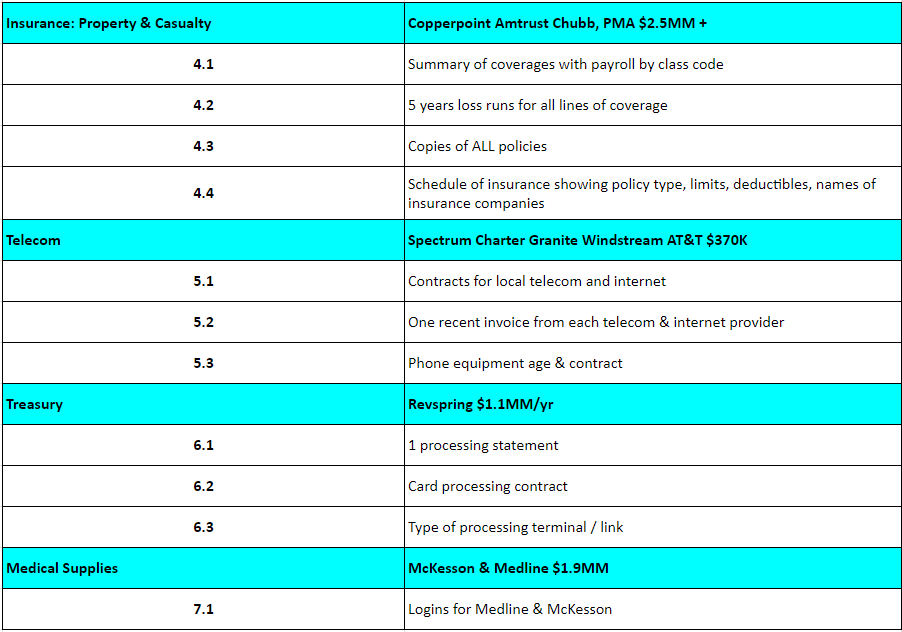

Insurance/Benefits

-

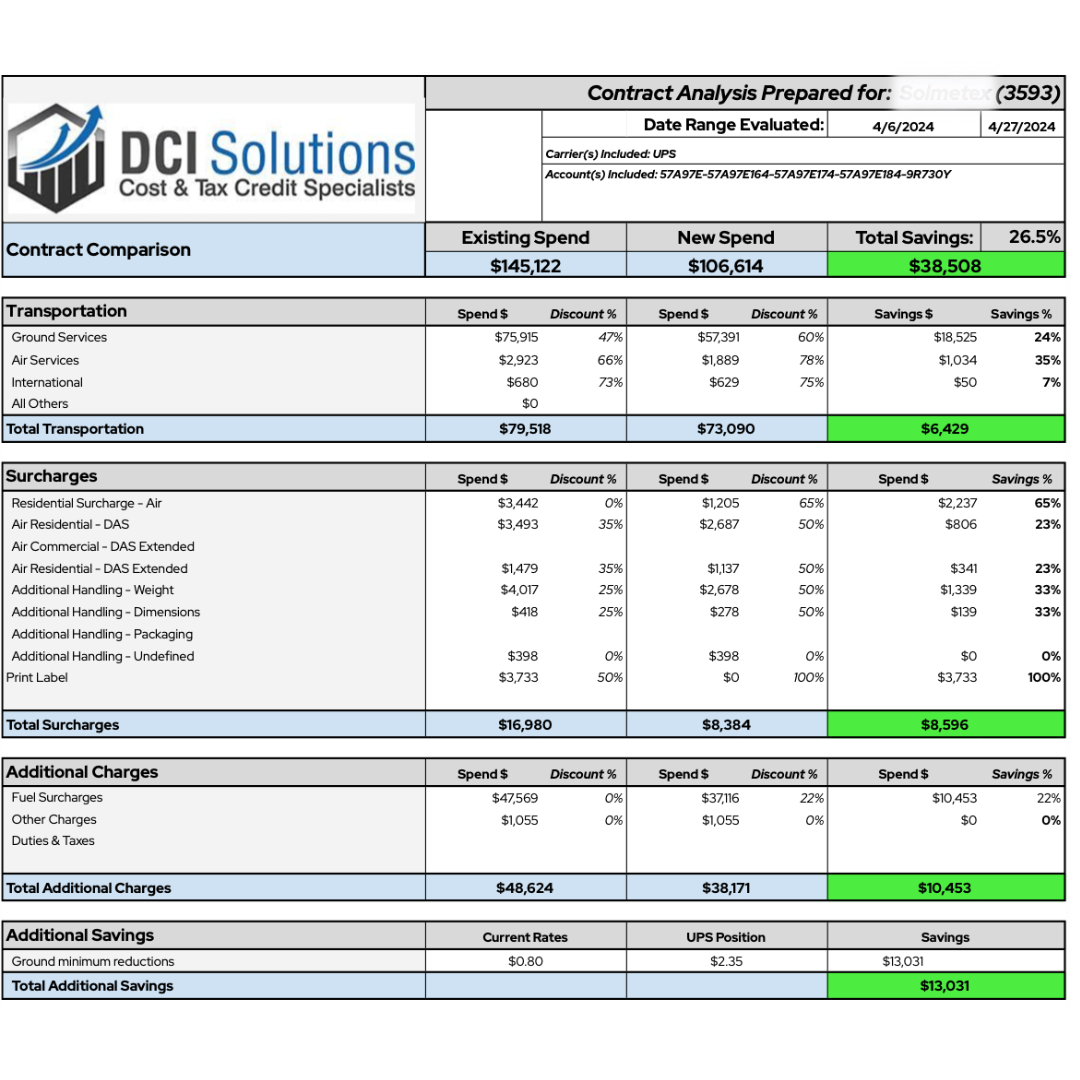

Freight

-

Telecommunications

-

Utilities

-

Services and Supplies

-

Real Estate

-

Treasury

-

Accounts Payable

OUR CLIENTS

The greatest threat to your company is the postponement of smart decisions-

the kind that cost you nothing and help you win everything.

When millions are at stake your biggest risk is doing nothing.

Questions Smart Clients Ask

(And what you should ask any cost audit partner before engaging them.)

DCI moves in sync with our clients’ operations to unobtrusively boost financial performance.

We also partner well with wealth management, advisory services, and accounting professionals.