INCREASE CASH FLOW

The company worth $50 million on Monday could be worth $55 million on Friday

Companies of any size realize average gains of $1k - $4k per full time employee without changing suppliers or wasting time.

$1000

MINIMUM SAVINGS PER EMPLOYEE PER YEAR

10%

UP TO 10% INCREASE TO ANNUAL BOTTOM LINE PROFITS

1

TOTAL DAYS OF EXECUTIVE TIME (8-1O HOURS)

DCI COST EFFICIENCY DASHBOARD

-

Tax Credits

-

Insurance/Benefits

-

Freight

-

Telecommunications

-

Utilities

-

Services and Supplies

-

Real Estate

-

Treasury

-

Accounts Payable

See Your Projected Annual Gain

Industry

Number of Full-Time Employees

Number of Part-Time Employees

What 3rd party audits in the previous 5 years?

Company Name

Your Name

Your Email

Number of states operating in

Questions People Ask

-

I pride myself on being a good cost-controller, should I bother?

As John Wooden said, “It’s what you learn after you know everything that counts.” We invite you to think like a true champion – never complacent with the status quo and always ready to learn what increases your profit and financial health.

-

Can we do what DCI does ourselves?

Although your company may have extremely capable people who have always done their best, there are specific tools and specialized “10,000 hour” skills employed by DCI that cannot be duplicated. Extensive databases of best-in-class pricing, tariff analysis skills, audit software, knowledge of unpublished discounts, along with the deep understanding of all the negotiating protocols necessary to obtain best pricing. We have never seen our practices duplicated by any company’s in-house staff. Even if you have used outside consultants recently and think you’ve gotten all the “low hanging fruit,” DCI’s confidential analysis will still uncover substantial opportunities for cost savings and tax refunds.

-

What are unpublished discounts?

Vendors apply unpublished discounts only in certain situations. The net lower rates can add up to significant amounts of money for you. The DCI team knows where, how and when to gain the highest discounts for you.

-

Will we need to change suppliers?

Most companies prefer to stay with their valued suppliers – why needlessly disrupt those relationships? With our process you maintain those quality relationship while ensuring that you get more discounts. Also, DCI can show you the best pricing and terms from your other quality suppliers, giving you more insight and better control of your best options.

-

Is there a fee to do a review of our company’s costs?

You will never have to pay upfront for anything, including the confidential analysis you receive three weeks after you give us your data. With DCI you will always be cash flow positive!

-

What’s our best upside?

Expect to grow your cash flow, profit and equity value 5% to 10% so you gain at least $1,000 per employee per year forever and without investing any money or facing any risk or any loss of your prerogative.

-

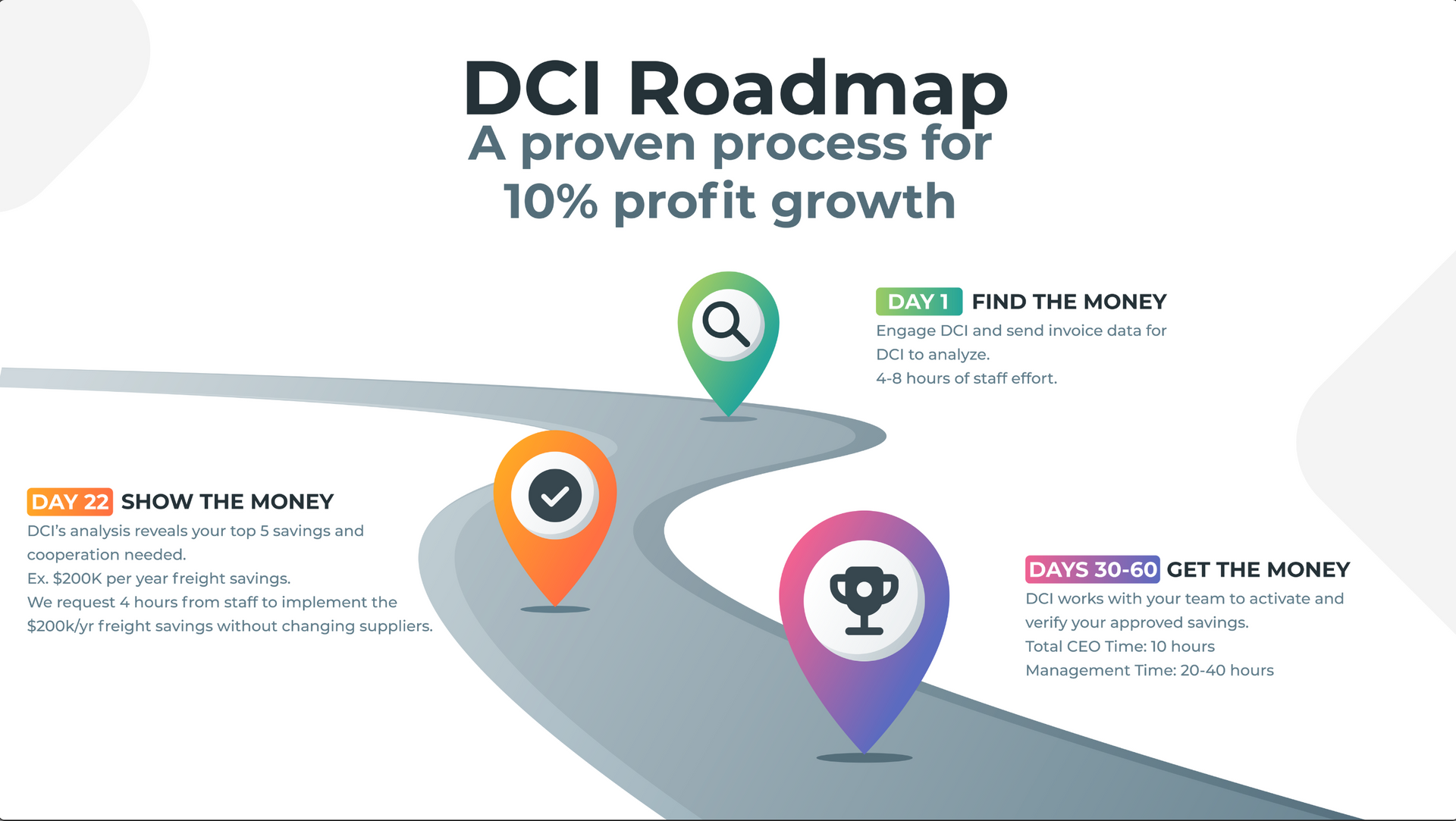

How much executive and staff time will be required?

Assuming you approve of the recommendations shown in our confidential report, your total executive time is limited to ten hours (about two hours each month for five months). Staff time invested is also a manageable ten hours — mostly helping DCI get access to invoice data.

-

What size businesses do you work with?

DCI will benefit the leader of any organization wanting large, sustainable increases in cash flow, profit, and market value. With proven expertise in large companies with thousands of employees and the flexibility to bring large gains to smaller companies, DCI will benefit the leader of any organization wanting large, sustainable increases in cash flow, profit, and market value.

-

Do I need to open my books and share sensitive information?

No, you don’t. We do not audit your books or comb through any sensitive or confidential information.

-

Does DCI do Process Improvement?

No. While it can be worthwhile, the results don’t always justify the time, energy, and human capital invested. We also do not review your processes, books or audit your direct cost of goods sold. Our focus is on SG&A vendor invoices and agreements.

-

What if we already have consultants?

Our flexibility enables us to show you where to gain significant refunds, rebates and discounts without duplicating work done by your consultants.

-

Are there any geographical limitations to work with DCI?

DCI provides our full range of services in all 50 states and select cost saving services for Canadian companies.

-

Isn’t our company too small?

Companies of all sizes are eligible for many of DCI’s proprietary tax savings strategies. Whatever the size of your company, you will benefit from significant dollar-for-dollar credits to your bottom line.

-

Can you find us a tax savings?

Your directly or indirectly taxed activities are likely eligible for more than one type of tax savings. We have never worked with a company where there wasn’t at least one type of tax savings available!

-

Does DCI think our company qualifies for tax savings?

DCI’s strategy finds tax savings that are seldom detected or optimized by even the brightest tax departments and outside CPA firms. DCI experts keep abreast of the continually changing state and federal tax regulations, which enables us to find your company any eligible tax credits

-

Isn’t this a waste of time? Are there any upfront costs?

NO and NO! DCI does all of the heavy lifting. We require a minimum amount of executive and staff time to develop a clear and accurate picture of your tax savings and a solution for recovering those monies in the most effective way. We thoroughly prepare all of the reports and documents of your available tax savings. Further, there are no upfront costs – we only get paid if you get any tax savings.

-

Can you guarantee we will save money?

98% of the time we produce $1,000 to $4,000 for every full time person our clients employ. We make you aware of the money to be gained and let you decide if you want to obtain it.

-

Will we need to change vendors?

The easiest way to save money is without changing suppliers. Our process ensures you get savings while maintaining the relationships you’re already comfortable with. We also make you aware of attractive pricing and terms from reputable alternatives so that you are fully informed regarding your best options.

-

How much should we expect to gain?

A well run company with 100 full-time employees should expect to see an extra $100,000 to $400,000 to its bottom line every year. For many companies, this result produces a 3% to 10% jump in equity value worth millions of dollars for the ownership.

-

Do you need to look at our books or other sensitive information?

We don’t need to look at your books or audit any sensitive information since that is more of an accounting function. Looking at non-confidential data and supplier invoices we can reveal to the owner where the best opportunities for tax and overhead savings exist.

What Our Clients Say

J.B. Owner of L.A. logistics company

CONTACT US

Note: Your details are kept strictly confidential as per our Privacy Policy

DCI Solutions | All Rights Reserved | Terms of Service

Created by Olive + Ash.

Managed by Olive Street Design.